Europe takes the lead: New ranking reveals surprising shift in the global venture capital landscape

The venture capital landscape, a critical driver of innovation and startup growth, has long been dominated by U.S.-based firms. These firms traditionally lead the way in funding emerging technologies and disruptive businesses globally. However, the latest HEC Paris-Dow Jones Venture Capital Performance Ranking, a study that evaluates the world’s top-performing VC firms, reveals a dramatic shift in this landscape.

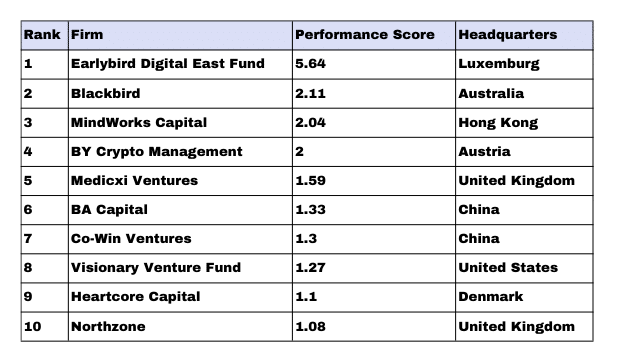

In a significant milestone for European venture capital, Luxembourg-based Earlybird Digital East Fund has claimed the top spot in the 2023 HEC Paris-Dow Jones Venture Capital Performance Ranking, marking the first time a European firm has secured the leading position. This third edition of the prestigious ranking, led by Professor Oliver Gottschalg of HEC Paris, reveals a shifting global venture capital landscape, with non-U.S. firms now occupying nine of the top ten positions, underscoring growing global competition in the sector.

Global competition intensifies

The emergence of Earlybird Digital East Fund as the top-performing firm highlights the increasing prominence of European venture capital. Known for its early investment in Romanian tech unicorn UiPath, Earlybird’s rise to the top signals the maturation of Europe’s startup ecosystem and its ability to compete with global leaders. This year, the Digital East Fund will take an independent path, breaking its ties with Berlin-based Earlybird.

Other notable firms in the top five include Australia’s Blackbird in second place and Hong Kong’s MindWorks Capital in third, further emphasizing the increasingly international nature of the venture capital landscape.

Professor Gottschalg reflected on the significance of this shift, stating, “Having a European VC at the top shows an important change in the global venture capital landscape. This reflects the strength of Europe’s innovation-driven economy and its growing impact on global markets.”

Top 10 Performers

The ranking demonstrates the broadening scope of global venture capital, with firms from Australia, Austria, China, Denmark, and the United Kingdom joining the upper ranks. Only one U.S. firm, Visionary Venture Fund, placed in the top 10, a stark contrast to last year’s rankings, where six U.S. firms dominated.

“It’s striking that only one U.S.-based VC made it into the top 10,” noted Gottschalg. “This global diversification signals expanding opportunities for investors, particularly in emerging markets.”

The presence of firms like Medicxi Ventures and Heartcore Capital demonstrates the growing influence of European VCs in supporting high-growth ventures. European firms, particularly in the technology and healthcare sectors, are showing strong results, reflecting the region’s innovation capacity.

Looking Ahead

While U.S. firms such as Visionary Venture Fund, NEXT Investors, and G Squared continue to play a role in the top 20, the overall ranking showcases a more balanced global investment landscape. Firms from Asia, Europe, and Australia are leading the charge, with Chinese firms making notable strides in the consumer goods sector.

“The competition is intensifying, and we anticipate even more innovation and high-growth ventures emerging from these diverse regions,” concluded Gottschalg, highlighting the growing significance of international players in shaping the future of venture capital.

This year’s ranking paints a picture of an increasingly competitive and diversified venture capital landscape, where emerging markets and international firms are stepping up to challenge the dominance of traditional U.S. powerhouses. As the VC ecosystem continues to evolve, investors worldwide will be watching closely to see how these trends play out.